Wise vs M-Pesa: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 10:50:08.0 23

Introduction

Cross-border money transfers are essential for individuals, businesses, and expatriates worldwide. Users often face high fees, hidden charges, slow transfers, and limited transparency, which can make sending money overseas challenging. Selecting the right provider can save both time and money.

Wise and M-Pesa are two popular services in this space. Wise is known for its transparent fees and mid-market exchange rates, while M-Pesa is widely used in Africa, offering mobile-based transfers that are convenient for local and regional remittances. Panda Remit is another emerging alternative, providing fast, low-cost transfers and multiple payment methods (https://www.pandaremit.com/).

For a deeper understanding of international transfers, see Investopedia’s guide on how international money transfers work (https://www.investopedia.com/articles/pf/08/international-banking-transfers.asp).

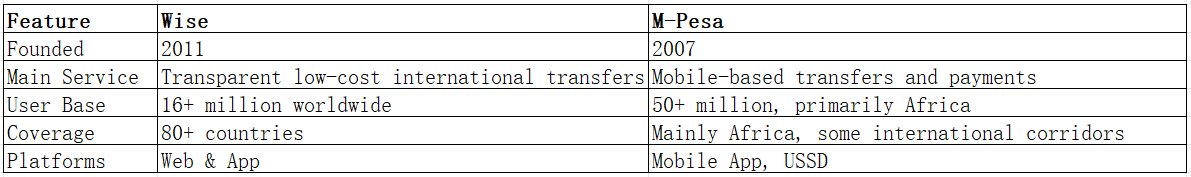

Wise vs M-Pesa – Overview

Wise, founded in 2011 in the UK, is recognized for its transparent pricing, multi-currency accounts, and debit card support. It serves over 16 million users globally and supports transfers to more than 80 countries via web and mobile platforms.

M-Pesa, launched in 2007 by Safaricom in Kenya, is a mobile-based money transfer and payment service primarily serving Africa and select international corridors. M-Pesa allows users to send money using their mobile phones without needing a traditional bank account.

Similarities: Both platforms facilitate international transfers, mobile access, and easy account management.

Differences: Wise emphasizes transparent fees and mid-market rates, while M-Pesa focuses on mobile accessibility and ease of use in emerging markets.

Panda Remit is a growing competitor, offering low-cost international transfers with broad currency coverage (https://www.pandaremit.com/).

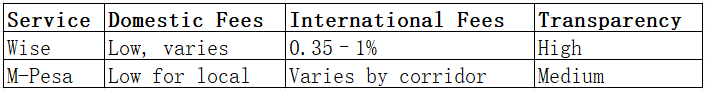

Wise vs M-Pesa: Fees and Costs

Wise charges a small percentage-based fee (typically 0.35–1%) depending on the currency and amount. All transfers use the mid-market exchange rate, with no hidden charges.

M-Pesa fees depend on the amount sent and the recipient’s location, with domestic transfers often cheaper than international. International transfers may include exchange rate markups and flat fees per transaction.

For a comprehensive comparison of transfer fees, see NerdWallet’s guide to the best international money transfer services (https://www.nerdwallet.com/best-money-transfer-services).

Panda Remit often offers lower-cost transfers and favorable rates for multiple corridors, making it a strong alternative.

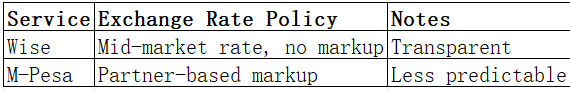

Wise vs M-Pesa: Exchange Rates

-

Wise provides the mid-market exchange rate with no hidden markup.

-

M-Pesa international transfers may include 1–3% markups depending on the partner provider and corridor.

Panda Remit also delivers competitive rates, often close to the mid-market, giving users additional savings.

Wise vs M-Pesa: Speed and Convenience

Wise transfers generally arrive in minutes to 1 business day, depending on currency pair and payment method. Its platforms support batch payments, multi-currency wallets, and debit cards.

M-Pesa is highly convenient for mobile users, especially within Africa, but international transfer times vary depending on the partner network and corridor.

For more on transfer speed, see the World Bank Remittance Prices guide (https://www.remittanceprices.worldbank.org/en).

Panda Remit offers fast transfers, often within minutes, supporting multiple payout methods.

Wise vs M-Pesa: Safety and Security

Both Wise and M-Pesa are regulated and secure:

-

Wise is authorized by the UK FCA and regulated globally.

-

M-Pesa works with licensed telecoms and banks, ensuring regulatory compliance.

Both services support fraud protection, encryption, and two-factor authentication. Panda Remit is also fully licensed and secure.

Wise vs M-Pesa: Global Coverage

Wise supports over 80 countries and 50+ currencies, ideal for global remittances.

M-Pesa primarily serves Africa, with limited international corridors.

For more on global remittance coverage, see the World Bank report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Wise vs M-Pesa: Which One is Better?

Wise is ideal for users seeking transparent fees, mid-market exchange rates, and broad global coverage.

M-Pesa is excellent for users in Africa who prioritize mobile convenience and local accessibility, but may be limited for wider international transfers.

Panda Remit provides speed, low fees, and multiple payment methods, making it a strong alternative for users looking for a cost-effective global solution.

Conclusion

Comparing Wise vs M-Pesa, the right choice depends on your transfer needs:

-

Wise: Transparent fees, mid-market rates, wide coverage.

-

M-Pesa: Mobile convenience, best for African corridors.

Panda Remit (https://www.pandaremit.com/) offers high exchange rates, low fees, flexible payment options (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fast, fully online transfers.

For more guidance, check NerdWallet (https://www.nerdwallet.com/) and World Bank Remittance Prices (https://remittanceprices.worldbank.org/en). Comparing Wise vs M-Pesa alongside Panda Remit ensures you select the most cost-effective, secure, and convenient international transfer service.