Wise vs PayerMax: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 16:09:29.0 14

Introduction

The global remittance market continues to expand in 2025 as individuals and businesses seek fast, secure, and affordable cross-border transfer solutions. Common frustrations include hidden fees, slow transfer times, and limited currency coverage. Wise and PayerMax have emerged as two distinct players—Wise appealing to individuals and freelancers, and PayerMax targeting global merchants and cross-border businesses.

However, Panda Remit is also gaining popularity as a cost-effective and reliable alternative for personal transfers. For a broader understanding of remittance services, see this Investopedia guide on money transfer services.

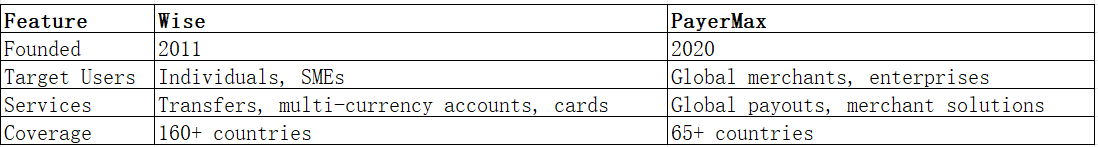

Wise vs PayerMax – Overview

Wise (founded 2011)

-

Known for transparent international transfers using the mid-market exchange rate.

-

Offers multi-currency accounts, debit cards, and transfers to 160+ countries.

-

Serves individuals, freelancers, and SMEs.

PayerMax (founded 2020)

-

Focuses on digital payments for businesses and merchants.

-

Offers global payout infrastructure covering 65+ countries.

-

Tailored to e-commerce platforms, game publishers, and digital services.

Similarities

-

Both provide cross-border transfers.

-

Support multiple currencies and digital platforms.

-

Emphasize digital-first solutions.

Differences

-

Wise focuses on individuals and small businesses.

-

PayerMax is business-centric, targeting enterprise merchants.

-

Fee structures and coverage models vary.

Quick Comparison Table

Panda Remit, meanwhile, positions itself as a consumer-focused alternative with competitive rates and easy transfers.

Wise vs PayerMax: Fees and Costs

Wise charges a transparent, percentage-based fee per transfer, often lower than traditional banks. Its real mid-market rate ensures no hidden markups.

PayerMax fees vary by business integration and transaction type, often negotiated with enterprise clients. For smaller transfers, Wise is usually cheaper, while PayerMax optimizes bulk payments for merchants.

For a broader fee analysis, visit NerdWallet’s international money transfer comparison.

Panda Remit frequently promotes lower transfer fees for individuals, making it attractive for cost-sensitive users.

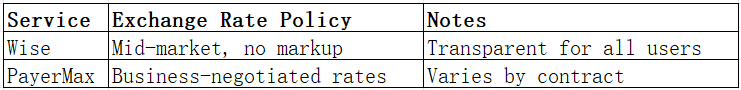

Wise vs PayerMax: Exchange Rates

Wise offers transfers at the mid-market exchange rate without hidden markups.

PayerMax may apply exchange margins depending on the business agreement, making rates less transparent compared to Wise.

Exchange Rate Comparison Table

Panda Remit is also competitive, often advertising strong exchange rates across 40+ currencies.

Wise vs PayerMax: Speed and Convenience

Wise delivers most transfers within minutes to 1 business day, depending on the payment method and country. Its mobile app and multi-currency account are highly rated for convenience.

PayerMax is optimized for business payouts, ensuring bulk payments are processed reliably, though individual transfer speeds may vary.

For details on transfer speeds, check Remitly’s guide on international transfer times.

Panda Remit is also known for fast transfers, often settling within minutes.

Wise vs PayerMax: Safety and Security

Wise is regulated by financial authorities in the EU, UK, US, and other regions, using encryption and fraud detection measures.

PayerMax is also licensed in multiple jurisdictions, catering to large enterprises that require strict compliance and transaction monitoring.

Panda Remit, as a licensed service provider, adheres to compliance and ensures secure transfers for personal users.

Wise vs PayerMax: Global Coverage

Wise supports transfers to over 160 countries with 40+ currencies.

PayerMax covers 65+ countries, mainly focusing on high-growth e-commerce and gaming markets.

For broader industry insights, see the World Bank Remittance Prices Worldwide report.

Wise vs PayerMax: Which One is Better?

Wise is best for individuals, freelancers, and small businesses seeking transparency, low fees, and easy transfers.

PayerMax is better for global enterprises needing reliable payout infrastructure.

However, for personal remittances, Panda Remit may provide better value, combining affordability, speed, and strong exchange rates.

Conclusion

When comparing Wise vs PayerMax, the decision depends largely on the user’s needs. Wise excels in providing affordable, transparent services for individuals and SMEs, while PayerMax is tailored for enterprise-level cross-border commerce.

For everyday remittances, Panda Remit emerges as a strong alternative:

-

Competitive exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank cards, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast, fully digital transfer process

To learn more about secure remittance practices, visit NerdWallet’s guide to international transfers.

For those who prioritize cost savings and convenience, Panda Remit offers a user-friendly platform: https://www.pandaremit.com.

Ultimately, the Wise vs PayerMax comparison shows both services excel in their domains, but Panda Remit stands out as a flexible solution for personal cross-border money transfers.