Wise vs PingPong Payments: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 11

Introduction

International money transfers have become essential for both individuals and businesses navigating global commerce. The common challenges include high fees, hidden markups, and slow delivery times. Today, Wise and PingPong Payments stand out as two major players, serving different audiences: Wise focuses on individuals and small businesses, while PingPong Payments is tailored for e-commerce sellers and enterprises managing international revenues.

Alongside these, Panda Remit has gained attention as a trusted remittance provider for individuals seeking faster and more affordable transfers. To better understand the complexities of cross-border payments, you can check Investopedia’s guide to money transfers.

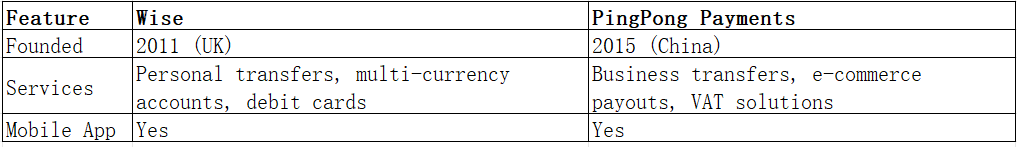

Wise vs PingPong Payments – Overview

Wise (founded in 2011 in the UK) provides low-cost international transfers, multi-currency accounts, and debit cards, with an emphasis on transparency. Its user-friendly platform has made it a favorite for individuals and small businesses alike.

PingPong Payments (founded in 2015 in China) specializes in global payment solutions for e-commerce sellers, freelancers, and businesses. It enables cross-border collections, supplier payments, and VAT solutions, with a strong presence in marketplaces like Amazon and Alibaba.

Both services offer international transfers, mobile apps, and compliance with regulatory standards. However, Wise is personal-transfer focused, while PingPong Payments is business-transfer focused.

Panda Remit enters the market as another alternative, focused on everyday users sending money home with speed and affordability.

Quick Overview Table

Wise vs PingPong Payments: Fees and Costs

Wise uses a simple fee structure: a small percentage of the amount plus a fixed fee. There are no hidden charges, and customers always see the final cost upfront.

PingPong Payments does not charge direct transfer fees in most cases, but instead makes money through exchange rate spreads. For businesses handling large transfers, this can add up significantly.

Compared to both, Panda Remit provides a competitive low-fee structure designed for personal remittances, ensuring more money reaches recipients.

For additional comparisons of transfer costs worldwide, see the World Bank Remittance Prices database.

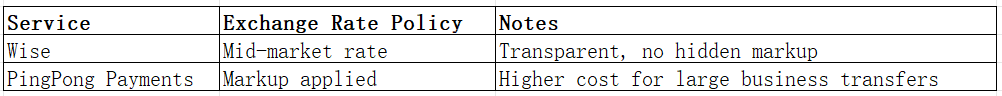

Wise vs PingPong Payments: Exchange Rates

Wise is known for providing the real mid-market exchange rate, with no markup. This makes it one of the most transparent services globally.

PingPong Payments applies a markup on the exchange rate, especially when converting large revenues from e-commerce platforms, which can make it more costly than Wise for frequent transfers.

Panda Remit also offers high exchange rates for personal remittances, allowing recipients to maximize their funds.

Exchange Rate Table

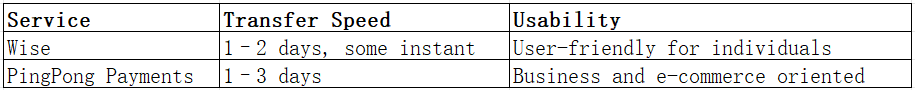

Wise vs PingPong Payments: Speed and Convenience

Wise transfers are usually delivered in 1–2 business days, with some instant transfers available depending on currency routes. Its app is streamlined for personal and small-business use.

PingPong Payments transfers take around 1–3 business days, optimized for payouts to e-commerce sellers, suppliers, and global partners. It integrates seamlessly with online marketplaces, making it highly convenient for business operations.

Panda Remit often processes transfers within minutes, positioning itself as a fast and user-friendly option for family remittances.

For more details on remittance speed, check NerdWallet’s guide to money transfers.

Speed & Convenience Table

Wise vs PingPong Payments: Safety and Security

Both Wise and PingPong Payments are regulated financial institutions. Wise is licensed in the UK, EU, US, and many other jurisdictions, using encryption and two-factor authentication.

PingPong Payments is regulated in multiple regions and adheres to strict compliance standards for business transactions, particularly in Asia, Europe, and North America.

Panda Remit is also fully licensed, providing safe, encrypted transactions with customer protection standards.

Wise vs PingPong Payments: Global Coverage

Wise supports over 70+ currencies and sends money to more than 170 countries worldwide.

PingPong Payments serves 200+ countries, focusing on cross-border collections for sellers and payouts to suppliers. However, its services are more business-centric rather than personal.

Panda Remit covers 40+ currencies and provides flexible payment options, including bank transfers, debit/credit cards, POLi, PayID, and e-wallets.

For a broader look at global remittance coverage, see the World Bank’s remittance data.

Wise vs PingPong Payments: Which One is Better?

The decision between Wise and PingPong Payments depends largely on whether you are an individual user or a business user.

-

Choose Wise if you want low-cost, transparent personal transfers or a multi-currency account.

-

Choose PingPong Payments if you are an e-commerce seller or business needing international payouts and VAT solutions.

-

Consider Panda Remit if you want a fast, affordable, and user-friendly option for personal remittances.

Conclusion

In the Wise vs PingPong Payments comparison, both services excel in different areas. Wise is ideal for individuals and small businesses thanks to its low fees, transparent mid-market rates, and intuitive app. PingPong Payments, on the other hand, dominates the e-commerce and business space, supporting sellers and enterprises with cross-border collections, supplier payments, and VAT management.

However, for users focused on personal remittances, Panda Remit provides a strong alternative. With high exchange rates, low fees, flexible payment methods (POLi, PayID, debit card, e-transfer, and more), coverage of 40+ currencies, and fast transfers, it delivers excellent value.

For further insights, explore the World Bank’s remittance reports or learn about remittance trends via NerdWallet. To compare Panda Remit directly, visit their official website: https://www.pandaremit.com.