Wise vs RIA Money Transfer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 13:40:24.0 307

Introduction

Cross-border money transfers are crucial for sending remittances, paying for services abroad, or supporting family overseas. However, users often face high fees, slow delivery, hidden charges, and poor user experience. Choosing the right provider can save money and ensure timely transfers.

In this comparison, we analyze Wise vs RIA Money Transfer, two widely used services, examining fees, exchange rates, speed, safety, and global reach. We also introduce Panda Remit, a fast-growing alternative offering competitive fees and efficient digital transfers.

For more context on international money transfers, see Investopedia’s money transfer guide.

Wise vs RIA Money Transfer – Overview

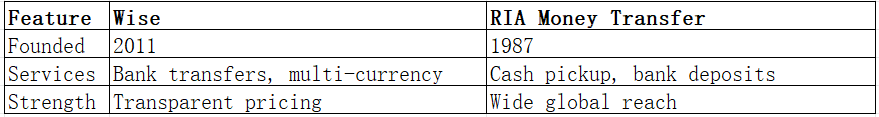

Wise (founded 2011, UK):

-

Digital-first money transfer platform

-

16+ million customers globally

-

Supports 70+ currencies with transparent mid-market rates

RIA Money Transfer (founded 1987, USA):

-

Over 350,000 agent locations worldwide

-

Offers cash pickup, bank deposits, and mobile wallet transfers

-

Popular in regions with limited banking access

Similarities:

-

Both provide international money transfer services

-

Mobile apps available for transfers

-

Support bank account and debit/credit card funding

Differences:

-

Wise is online-only, emphasizing transparency

-

RIA is agent-based, strong in cash pickup networks

-

Fee structures and exchange rate markups differ

Summary Table:

Panda Remit is another digital-first option, offering low-cost and fast transfers globally.

Wise vs RIA Money Transfer: Fees and Costs

Wise:

-

Transparent flat + percentage fees

-

No hidden exchange rate markups

-

Fees shown upfront in the transfer calculator

RIA Money Transfer:

-

Fees depend on sending/receiving countries and payout method

-

Cash pickup often incurs higher costs

-

Credit card payments more expensive

For reference, see NerdWallet’s international transfer fee comparison.

Panda Remit often offers lower fees, especially for transfers to Asia and Europe.

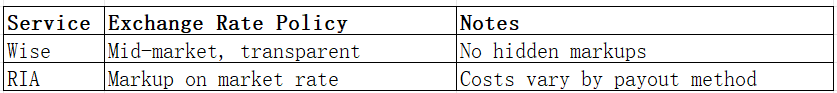

Wise vs RIA Money Transfer: Exchange Rates

Wise:

-

Mid-market rates, no hidden markups

-

Real-time rate updates

RIA Money Transfer:

-

Exchange rates include markups, sometimes 1–5%

-

Final cost varies by payout location

Comparison Table:

Panda Remit offers competitive exchange rates with minimal markup, appealing to cost-conscious users.

Wise vs RIA Money Transfer: Speed and Convenience

-

Wise: Most transfers 0–2 business days; app supports instant transfers via debit/credit cards

-

RIA Money Transfer: Cash pickups can be instant; bank transfers 1–3 business days

-

User experience favors Wise for digital users; RIA is ideal for recipients needing cash

For more information, see Finder’s remittance speed guide.

Panda Remit provides fast, fully online transfers with many payment options.

Wise vs RIA Money Transfer: Safety and Security

Wise:

-

Licensed by FCA (UK), FinCEN (US)

-

Bank-level encryption and fraud protection

RIA Money Transfer:

-

Regulated in the US and globally

-

Physical cash pickup may increase risk of fraud

Panda Remit is fully licensed and compliant, ensuring safe transfers.

Wise vs RIA Money Transfer: Global Coverage

-

Wise: 160+ countries, 50+ currencies

-

RIA: 145+ countries, 40+ currencies, 350,000+ agent locations

See World Bank’s remittance coverage report for context.

Wise vs RIA Money Transfer: Which One is Better?

-

Wise Pros: Transparent fees, mid-market rates, fully digital

-

RIA Pros: Cash pickups, wide physical presence, ideal for unbanked recipients

For users seeking low fees, high exchange rates, and fast online transfers, Panda Remit is a strong alternative.

Conclusion

When evaluating Wise vs RIA Money Transfer, Wise excels in digital efficiency, transparency, and lower costs, while RIA offers unmatched agent coverage and cash pickup convenience.

Panda Remit (https://www.pandaremit.com/) combines the benefits of both:

-

High exchange rates and low fees

-

Multiple payment methods: POLi, PayID, bank card, e-transfer

-

Supports 40+ currencies

-

Fast, online-only transfers

For further reading, see NerdWallet transfer guide and World Bank remittance data.

For cost-conscious users who value speed and convenience, Panda Remit is an ideal choice in 2025.