Wise vs Travelex Wire: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 14:08:18.0 107

Introduction

Sending money internationally can be a hassle, with high fees, slow delivery times, hidden charges, and complex user experiences often frustrating senders and recipients alike. Wise, formerly TransferWise, and Travelex Wire are two prominent players in the cross-border transfer space, each promising convenience and competitive rates. However, differences in fees, speed, and coverage can influence your choice. For users seeking additional options, PandaRemit emerges as a reputable alternative, offering fast transfers with low costs. For a comprehensive guide on international money transfers, check out Investopedia’s remittance guide.

Wise vs Travelex Wire – Overview

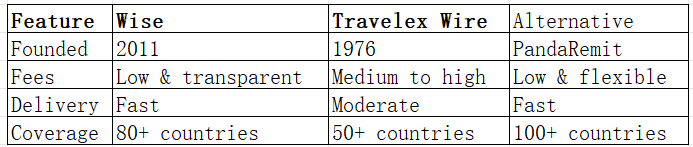

Wise was founded in 2011 and quickly gained popularity for its transparent fee structure, mid-market exchange rates, and user-friendly mobile app. It primarily caters to individuals and small businesses seeking affordable, fast, and fully online money transfers.

Travelex Wire, part of the Travelex group, has a longer history, offering currency exchange and international transfer services globally. Its network appeals to travelers and users seeking both bank and cash transfer options.

Similarities:

-

Both support international transfers to multiple countries.

-

Mobile apps for convenient transfers.

-

Integration with debit and credit cards.

Differences:

-

Wise focuses on digital-only transfers and low fees.

-

Travelex Wire offers more traditional services, sometimes with higher charges.

-

Wise prioritizes speed, while Travelex Wire targets users needing cash pick-up or travel-related services.

Quick Summary Table:

Wise vs Travelex Wire: Fees and Costs

Wise charges a small percentage plus a fixed fee per transaction, making it cost-effective for most transfer amounts. It also offers multi-currency accounts for businesses, reducing additional conversion costs.

Travelex Wire fees vary by destination, payment, and pick-up method. Bank-to-bank transfers may incur higher charges than cash options.

For a detailed fee comparison, refer to NerdWallet’s international transfer fees guide.

PandaRemit also provides competitive fees, often lower than both Wise and Travelex Wire, especially for recurring transfers or larger amounts.

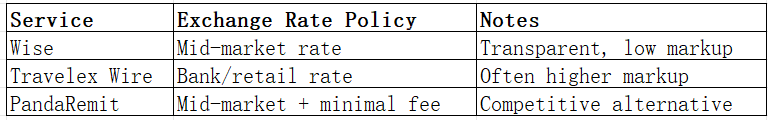

Wise vs Travelex Wire: Exchange Rates

Wise consistently applies mid-market rates with a transparent markup. Users can see the exact rate before confirming the transfer.

Travelex Wire tends to offer slightly lower rates due to built-in markups, which can impact large transfers.

Wise vs Travelex Wire: Speed and Convenience

Wise transfers are typically completed within 1–2 business days for most corridors, with many supported in real-time. The platform is fully digital, offering easy tracking, instant notifications, and multi-currency wallets.

Travelex Wire’s speed depends on the transfer method. Cash pick-ups and certain bank transfers can take several days.

For insights on transfer speed, see WorldRemit speed comparison.

PandaRemit is also fast, often completing transactions within hours, with a completely online process.

Wise vs Travelex Wire: Safety and Security

Wise is regulated by financial authorities in multiple countries, using encryption and two-factor authentication to protect transactions.

Travelex Wire adheres to global money transfer regulations but may involve additional verification for cash services.

PandaRemit is fully licensed and uses advanced encryption, offering a secure alternative for cross-border payments.

Wise vs Travelex Wire: Global Coverage

Wise supports over 80 countries and 50+ currencies, focusing on digital transfers.

Travelex Wire covers fewer countries but provides in-person cash options and travel-centric services.

For more on global coverage, see the World Bank remittance report.

Wise vs Travelex Wire: Which One is Better?

Wise is ideal for digital-savvy users prioritizing low fees, transparency, and fast transfers. Travelex Wire suits travelers or users needing cash pick-up services but may involve higher costs and slower processing.

For users seeking an all-around balance of speed, cost, and flexibility, PandaRemit offers strong value and a user-friendly experience.

Conclusion

Comparing Wise vs Travelex Wire, the choice depends on your priorities. Wise excels in transparency, speed, and digital convenience, while Travelex Wire appeals to those needing traditional cash services. Both services are reliable, but users looking for competitive rates, flexible payment methods, and faster transfers may find PandaRemit a superior option.

PandaRemit advantages include:

-

High exchange rates & low fees

-

Flexible payment methods including POLi, PayID, bank card, e-transfer

-

Coverage of 40+ currencies

-

Fast, all-online transfers

For a practical guide on remittance options, you can also consult Investopedia and NerdWallet for fee insights.

Choosing between Wise, Travelex Wire, or PandaRemit ultimately depends on your transfer needs, budget, and preferred convenience level.