Wise vs Western Union: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 10:58:13.0 17

Introduction

Sending money across borders has become a necessity for millions of people—whether for supporting family, paying for services, or conducting international business. However, many users face challenges such as high fees, hidden exchange rate markups, and slow delivery times. Choosing the right provider can make a significant difference in cost and convenience.

Two of the most popular options in this space are Wise and Western Union, each with distinct strengths and weaknesses. As we compare these two giants, we’ll also mention Panda Remit (https://www.pandaremit.com/), a newer but reputable digital-first alternative that offers competitive rates and fast service. For a broader context on international transfers, you can check resources like Investopedia’s guide on money transfers.

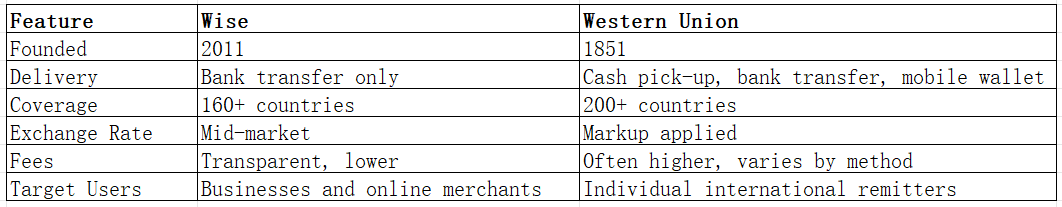

Wise vs Western Union – Overview

Wise

Founded in 2011 in London, Wise (formerly TransferWise) revolutionized the remittance market by introducing transparent, mid-market exchange rates. Wise serves over 16 million customers worldwide and specializes in online, app-based transfers directly to bank accounts. Its target audience includes individuals, freelancers, and businesses seeking low-cost, digital-first solutions.

Western Union

Western Union, established in 1851, is one of the oldest and largest money transfer services globally. With over 500,000 agent locations in 200+ countries, it is ideal for people without bank accounts or those preferring cash pick-up options. Western Union caters to both online and offline users, with a strong presence in rural and underserved areas.

Key Similarities

-

Support for international transfers across multiple currencies

-

Mobile apps for both Android and iOS

-

Options for debit/credit card payments

Key Differences

-

Wise: Transparent pricing, lower fees, mid-market exchange rates, digital-only.

-

Western Union: Extensive agent network, cash pick-up services, higher fees, variable exchange rates.

Note: Alongside these two, Panda Remit also provides a competitive online solution with low costs and multi-currency support.

Wise vs Western Union: Fees and Costs

Fees are one of the biggest considerations in choosing a transfer provider.

-

Wise: Uses a transparent fee structure that varies by currency and payment method. Fees are typically lower compared to traditional providers because Wise doesn’t apply a markup to exchange rates.

-

Western Union: Fees depend heavily on the sending and receiving countries, transfer method (cash pick-up, bank deposit, mobile wallet), and payment method (bank account, card, or cash). Cash pick-ups often cost more.

For reference, you can explore NerdWallet’s international money transfer comparison.

👉 If minimizing fees is a priority, Wise is generally cheaper, though Panda Remit often matches or even beats Wise with low-cost transfers.

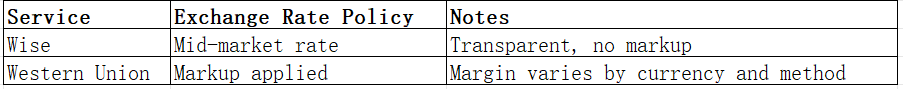

Wise vs Western Union: Exchange Rates

Exchange rate margins significantly affect how much money the recipient gets.

-

Wise: Uses the real mid-market rate, the same one you’d find on Google or XE.com, without hidden markups.

-

Western Union: Adds a margin on top of the exchange rate, which can reduce the amount received. The margin depends on the corridor and delivery method.

Here, Wise clearly wins for transparency. However, Panda Remit also offers highly competitive rates close to the mid-market standard.

Wise vs Western Union: Speed and Convenience

-

Wise: Transfers usually take a few hours to a day, depending on the currency and banking system. Some transfers can be instant with supported payment methods.

-

Western Union: Known for fast cash pick-up, often within minutes. Bank transfers may take longer.

App usability also differs: Wise focuses on simplicity and cost transparency, while Western Union balances online features with a vast offline agent network.

For more insights on remittance speed, see Remittance Prices Worldwide.

👉 For digital convenience, Wise is superior, but for urgent cash pick-ups, Western Union remains unmatched. Panda Remit offers a fast, fully online alternative with same-day delivery in many corridors.

Wise vs Western Union: Safety and Security

Both providers are licensed and regulated globally:

-

Wise: Authorized by the UK’s Financial Conduct Authority (FCA) and other regulators worldwide. Uses advanced encryption and strong identity verification.

-

Western Union: Licensed in all operating countries, with strong anti-fraud and compliance programs.

Both are safe to use. Similarly, Panda Remit is a licensed remittance provider that complies with international financial regulations and uses bank-level security.

Wise vs Western Union: Global Coverage

-

Wise: Available in 160+ countries and supports 40+ currencies, but only delivers to bank accounts.

-

Western Union: Operates in 200+ countries with a wide variety of payout options, including cash, mobile wallets, and bank accounts.

For an overview of global remittance corridors, see the World Bank’s remittance data.

👉 For bank-to-bank transfers, Wise is more efficient. For cash pick-up in rural areas, Western Union leads. Meanwhile, Panda Remit offers a hybrid—digital transfers with wide currency support.

Wise vs Western Union: Which One is Better?

-

Wise is ideal for:

-

Cost-conscious users who want mid-market exchange rates

-

Digital-savvy customers comfortable with online platforms

-

Businesses managing cross-border payments

-

-

Western Union is ideal for:

-

People needing instant cash pick-up

-

Users in rural or unbanked regions

-

Those who prioritize convenience of physical locations

-

For many users, Panda Remit provides a strong middle ground: lower fees like Wise, speed similar to Western Union, and flexible online transfers across 40+ currencies.

Conclusion

When comparing Wise vs Western Union, the right choice depends on your needs. Wise stands out for its low fees, mid-market rates, and digital-first approach, making it perfect for users seeking affordable, transparent bank transfers. Western Union, on the other hand, excels with its global agent network and cash pick-up options, serving customers who value accessibility over cost efficiency.

For users who want the best of both worlds, Panda Remit (https://www.pandaremit.com/) is worth considering. With:

-

High exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast transfers with a fully online process

…it combines digital convenience with affordability.

If you’re looking for a practical solution in 2025, comparing Wise vs Western Union is a great start—but don’t overlook innovative alternatives like Panda Remit. For further reading, explore resources such as NerdWallet’s transfer service reviews or Investopedia’s money transfer guide.