Wise vs XE Money Transfer: Which Service is Better in 2025?

Benjamin Clark - 2025-09-30 15:24:57.0 180

Introduction

Sending money internationally has become increasingly common, yet users still face challenges such as high fees, hidden charges, slow delivery, and complex interfaces. Choosing the right service can save time and money while ensuring safe transfers. In this Wise vs XE Money Transfer comparison, we explore each provider’s strengths and limitations to help you make informed decisions. For those seeking additional options, PandaRemit offers a reliable alternative with competitive rates and fast, convenient transfers. Learn more about remittance basics on Investopedia.

Brand A vs Brand B – Overview

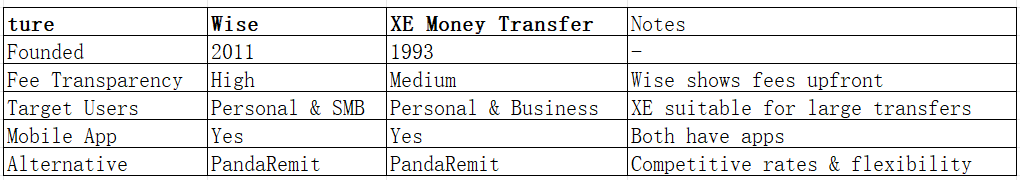

Wise (Brand A) was founded in 2011 and has rapidly grown into one of the most popular international money transfer platforms, serving millions of users worldwide. Its main services include cross-border bank transfers, multi-currency accounts, and debit card payments. Wise is known for transparency, low fees, and real mid-market exchange rates.

XE Money Transfer (Brand B), established in 1993, is part of a trusted currency information brand. XE provides international transfers with no maximum limits, live exchange rate tracking, and mobile app support. It appeals to both personal and business users who handle larger sums of money.

Similarities:

-

Both offer international transfers and mobile apps.

-

Support multi-currency wallets and bank card payouts.

-

Regulated and secure for cross-border transactions.

Differences:

-

Wise charges lower, transparent fees and favors smaller transfers.

-

XE’s strength lies in larger transfers and advanced rate alerts.

-

UX differences: Wise’s interface is simpler, XE offers more analytics and tracking features.

Brand A vs Brand B: Fees and Costs

Wise is widely recognized for low, transparent fees based on a fixed percentage plus a small flat fee. Domestic transfers are generally cheaper, and international transfers reflect the real mid-market rate. XE, while offering free transfers in some corridors, can impose a markup on the exchange rate and higher fees for certain payout methods.

For regular users, XE’s Business XE account may provide better rates for high-volume transfers, but Wise remains more cost-effective for smaller amounts. PandaRemit also offers low fees, making it a strong alternative for budget-conscious users. For a detailed fee comparison, visit NerdWallet’s money transfer guide.

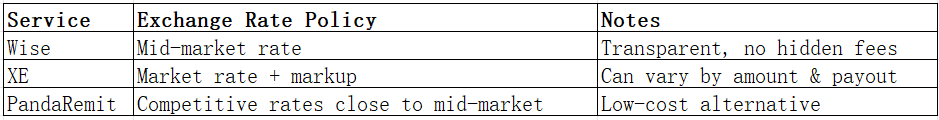

Brand A vs Brand B: Exchange Rates

Exchange rates play a critical role in the total cost of international transfers. Wise prides itself on offering the mid-market rate with no hidden markups, while XE may add a margin depending on the corridor and amount.

PandaRemit again emerges as a competitive option for users looking for low-fee transfers without sacrificing rate quality.

Brand A vs Brand B: Speed and Convenience

Wise transfers typically take 1–2 business days depending on the currency and payment method. XE transfers can range from instant (via certain corridors) to several business days for bank deposits. Both platforms offer mobile apps with convenient tracking features.

PandaRemit is designed for speed, often completing transfers within hours, and supports multiple payout methods including POLi, PayID, and debit/credit cards. For more on transfer times, see Remitly’s speed guide.

Brand A vs Brand B: Safety and Security

Both Wise and XE are licensed financial institutions regulated in multiple jurisdictions, ensuring encryption, fraud protection, and buyer safeguards. Users can confidently send money knowing their funds are secure.

PandaRemit is also licensed and regulated, offering robust security protocols and fraud monitoring to ensure safe transactions.

Brand A vs Brand B: Global Coverage

Wise supports over 80 countries and 50+ currencies, while XE covers 130+ countries with 60+ currencies. Both providers allow bank, debit, and digital wallet payments depending on the region.

For global remittance statistics and coverage, see World Bank Remittance Data.

Brand A vs Brand B: Which One is Better?

Choosing between Wise and XE depends on your priorities:

-

Wise: Best for low-cost, small-to-medium transfers, transparent fees, and user-friendly experience.

-

XE: Ideal for larger transfers, live rate alerts, and business users seeking advanced analytics.

For those seeking faster transfers, multiple payment options, and competitive rates, PandaRemit may offer superior convenience and value.

Conclusion

In the Wise vs XE Money Transfer debate, Wise stands out for low fees and transparent mid-market rates, while XE caters to high-volume and business-focused transfers. Both platforms are secure, well-established, and offer solid global coverage.

However, for users prioritizing speed, flexible payment options, and a simple all-online experience, PandaRemit is a compelling alternative. It provides:

-

High exchange rates & low fees

-

Multiple payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast transfers with a fully digital process

Explore more about PandaRemit on their official website and see why it’s a strong alternative in the international money transfer space. For additional comparisons and global money transfer insights, visit Investopedia and NerdWallet.