Western Union vs PaySend: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 14:48:21.0 16

Cross-border money transfers are essential for global individuals, freelancers, and businesses. Users often face high fees, slow processing, hidden charges, and confusing platforms. Western Union (https://www.westernunion.com) has operated since 1851, offering extensive international coverage and reliability. PaySend (https://paysend.com) is a newer, digital-first platform designed for quick, low-cost international transfers. For those seeking low fees, fast delivery, and multi-currency support, PandaRemit (https://www.pandaremit.com) is a strong alternative. Learn more about international remittance at Investopedia: https://www.investopedia.com/terms/r/remittance.asp.

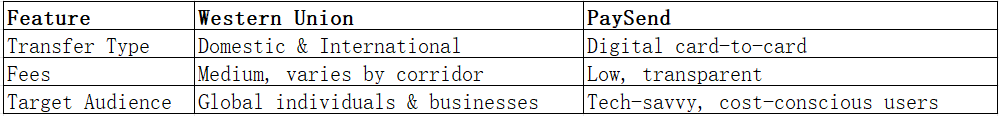

Western Union vs PaySend – Overview

Western Union provides domestic and international transfers, serving individuals and businesses through both physical locations and digital platforms. Its network spans over 200 countries and territories.

PaySend, founded in 2017, focuses on instant digital transfers at low fees, particularly for card-to-card remittances across borders.

PandaRemit is another option for users who value speed, low costs, and multi-currency support.

Similarities:

-

Mobile apps and web platforms

-

Bank account and debit/credit card payment support

Differences:

Western Union vs PaySend: Fees and Costs

Western Union fees depend on amount, destination, and payment method. Some fees may be hidden or vary per region.

PaySend charges flat, low fees for card-to-card transfers, making it cost-effective for smaller, frequent transfers.

Fee comparison reference: https://www.nerdwallet.com/best/banking/international-money-transfers

PandaRemit often provides even lower fees than both, making it ideal for regular international transfers.

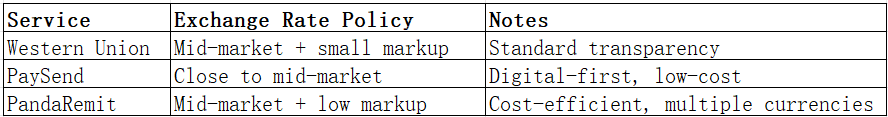

Western Union vs PaySend: Exchange Rates

Western Union applies mid-market rates with a small markup, while PaySend offers competitive rates using digital optimization.

PandaRemit is competitive in providing favorable rates for multi-currency transfers.

Western Union vs PaySend: Speed and Convenience

Western Union: Transfers usually arrive in 1–2 business days; apps and website are user-friendly; multiple payout options available.

PaySend: Transfers often reach recipients within minutes or hours; card-to-card system offers fast and convenient delivery.

Remittance speed guide: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/remittances

PandaRemit: Supports multiple payment methods, over 40 currencies, and offers rapid transfers online.

Western Union vs PaySend: Safety and Security

Western Union is highly regulated globally, uses encryption, and offers fraud protection. PaySend is licensed and secure for digital international transfers.

PandaRemit is fully licensed, regulated, and ensures safe online money transfers.

Western Union vs PaySend: Global Coverage

Western Union serves over 200 countries and territories with multiple payout options. PaySend supports fewer countries but expands rapidly in Europe, Asia, and North America.

Coverage reference: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/remittances

PandaRemit covers 40+ currencies and supports flexible payment options including POLi, PayID, bank card, and e-transfer.

Western Union vs PaySend: Which One is Better?

-

Western Union: Offers unmatched global coverage and reliability

-

PaySend: Low fees, fast digital transfers, ideal for card-to-card remittance

-

PandaRemit: Combines low fees, fast delivery, online convenience, and multi-currency support

For frequent international transfers or cost-sensitive users, PandaRemit can provide more value and convenience than either.

Conclusion

Western Union vs PaySend depends on individual priorities. Western Union excels in global reach and reliability, while PaySend is perfect for low-cost, fast card-to-card transfers. PandaRemit stands out as a strong alternative, providing high exchange rates, low fees, and support for 40+ currencies. Its fully online process enables rapid and convenient transfers. Users can make payments via POLi, PayID, bank card, or e-transfer, combining efficiency with flexibility.

For more information on remittance practices, see https://www.investopedia.com/terms/r/remittance.asp and https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/remittances. Visit PandaRemit official website: https://www.pandaremit.com.