Western Union vs Chime: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 15:53:04.0 16

Introduction

Sending money internationally is a common need for both individuals and businesses. High fees, slow delivery, hidden charges, and complicated platforms are frequent challenges for users. This article examines Western Union vs Chime, comparing fees, exchange rates, transfer speed, security, and coverage. For those looking for a cost-effective and fast alternative, PandaRemit offers fully online transfers with competitive rates and multiple payout options.

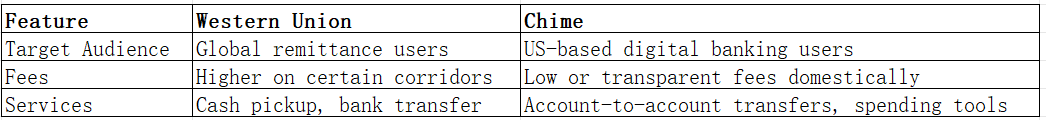

Western Union vs Chime – Overview

Western Union (founded 1851) is a globally recognized money transfer service with presence in over 200 countries. It supports cash pickup, bank transfers, and mobile payments.

Chime (founded 2013) is a US-based digital bank offering mobile-first banking solutions, including domestic and limited international transfers via bank accounts and debit cards.

Similarities:

-

Both offer online and mobile access

-

Debit card integration

-

Domestic and international transfers

Differences:

PandaRemit is another alternative, offering low-cost online transfers globally.

Reference: https://www.nerdwallet.com/best/banking/international-money-transfer

Western Union vs Chime: Fees and Costs

Western Union fees vary by country, payment method, and payout type. Cash pickups usually cost more than bank transfers.

Chime focuses on transparent domestic fees and minimal hidden costs for transfers linked to bank accounts.

Account Considerations:

-

Western Union: No subscription, pay-per-transfer

-

Chime: Free accounts with low-fee transfers

PandaRemit provides a low-cost alternative for frequent international transfers.

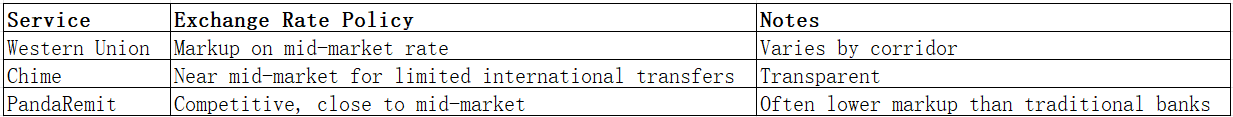

Western Union vs Chime: Exchange Rates

PandaRemit is ideal for users wanting maximum value per transfer.

Western Union vs Chime: Speed and Convenience

Transfer Times:

-

Western Union: Instant to a few hours (cash pickup), 1–3 business days (bank transfers)

-

Chime: 1–2 business days (account-to-account transfers)

App & Usability:

-

Western Union: Mobile app with multiple payout options

-

Chime: Mobile-first interface, budgeting tools, easy account transfers

Reference: https://www.worldremit.com/en/speed

PandaRemit offers fully online fast transfers as a convenient alternative.

Western Union vs Chime: Safety and Security

Both brands employ strong security measures:

-

Regulation: Western Union globally licensed, Chime regulated by US authorities

-

Encryption and fraud protection

-

Buyer protection

PandaRemit is also licensed and secure for international transfers.

Western Union vs Chime: Global Coverage

-

Western Union: Over 200 countries, multiple currencies, cash pickup, and bank transfers

-

Chime: US-focused, limited international coverage through partner networks

Reference: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues

Western Union vs Chime: Which One is Better?

-

Western Union: Best for users needing global reach and cash pickup

-

Chime: Suited for US users seeking low fees and mobile-first banking

For users needing low fees, speed, and multi-currency support, PandaRemit offers superior value.

Conclusion

When comparing Western Union vs Chime, both provide reliable money transfer solutions. Western Union excels in global reach and cash pickup, while Chime is ideal for US digital banking users.

For fast, low-fee, and flexible international transfers, PandaRemit offers:

-

Competitive exchange rates & low fees

-

Multiple payment methods: POLi, PayID, bank card, e-transfer

-

Coverage across 40+ currencies

-

Fully online, fast transfers

In the Western Union vs Chime comparison, the right choice depends on whether you value global coverage or convenience. PandaRemit is a modern, efficient alternative.

Official PandaRemit Site: https://www.pandaremit.com

Investopedia Remittance Tips: https://www.investopedia.com/articles/personal-finance/080815/best-ways-send-money-internationally.asp