Western Union vs Monzo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 15:31:36.0 24

Introduction

Cross-border money transfers are essential for millions of people worldwide—whether for supporting family abroad, paying for education, or managing international business. Yet, common challenges like high fees, slow delivery, hidden markups, and complex user experiences often get in the way.

Two popular services are Western Union and Monzo, each serving different user segments. At the same time, Panda Remit (https://www.pandaremit.com) is emerging as a strong, low-cost digital alternative.

For a detailed overview of remittances, visit:

https://www.investopedia.com/terms/r/remittance.asp

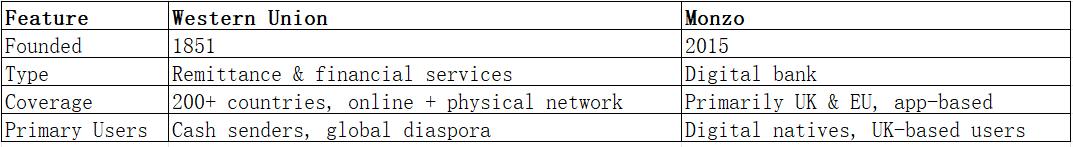

Western Union vs Monzo – Overview

Western Union (founded in 1851) is one of the oldest and largest money transfer companies in the world. It operates in over 200 countries and territories, with a massive agent network that supports both online and in-person transactions. Services include international transfers, bill payments, and business solutions—particularly useful for senders relying on cash.

Monzo (founded in 2015, UK) is a digital bank with millions of users. Its mobile-first approach focuses on convenience, transparency, and low fees. Monzo enables international transfers through third-party providers, primarily targeting tech-savvy customers in the UK and EU.

While both offer international transfers, Western Union focuses on global reach and cash-based flexibility, whereas Monzo is 100% digital, catering mainly to younger, urban customers.

Panda Remit (https://www.pandaremit.com) is another player in the market, offering low fees, high exchange rates, and an all-online experience.

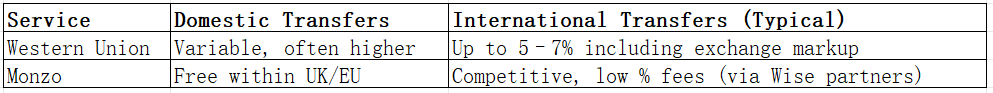

Western Union vs Monzo: Fees and Costs

Western Union’s fees vary significantly based on destination, payment method, and payout method. Cash pickups often incur higher charges than bank transfers, and total costs (including exchange markups) can exceed 5–7% in some corridors.

Monzo, meanwhile, partners with Wise for cross-border transfers. Fees are transparent and generally low, typically including a small flat fee plus a minimal percentage markup.

For more data, see NerdWallet’s fee comparison:

https://www.nerdwallet.com/best/international-money-transfer

Panda Remit frequently offers zero transfer fees for many corridors, with exchange rates close to the mid-market, making it one of the most affordable options.

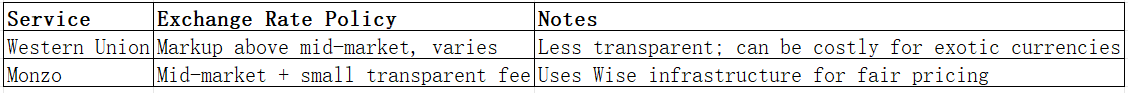

Western Union vs Monzo: Exchange Rates

Exchange rate markups can be a major hidden cost.

-

Western Union usually applies a markup above the mid-market rate, which varies depending on currency pairs.

-

Monzo, via Wise, offers near mid-market rates with transparent fees, often making it cheaper.

Panda Remit follows a mid-market exchange policy with minimal or no markup, making it competitive especially for larger transfers or emerging market currencies.

Western Union vs Monzo: Speed and Convenience

Western Union offers instant cash pickup in many locations, ideal for recipients without bank accounts. Online transfers typically take 1–3 business days, depending on the corridor.

Monzo transfers usually arrive within a few hours to one day, depending on the recipient’s country and local banking systems. Its user interface is clean and intuitive, but there are no cash pickup options.

For more on transfer speeds, see:https://www.pymnts.com/

Panda Remit (https://www.pandaremit.com) often delivers within minutes to a few hours, combining speed with fully digital convenience.

Western Union vs Monzo: Safety and Security

Both services are well regulated and use industry-standard security:

-

Western Union is licensed worldwide, uses encryption, and has anti-fraud protections. However, its cash network can be vulnerable to scams if users aren’t cautious.

-

Monzo is regulated by the UK’s Financial Conduct Authority (FCA), uses strong encryption, and offers excellent in-app security controls.

Panda Remit is also a licensed remittance provider, applying bank-level encryption and regulatory compliance to keep transactions secure.

Western Union vs Monzo: Global Coverage

Western Union is unmatched in coverage, operating in 200+ countries and offering multiple payout options including bank deposit, mobile wallets, and cash pickups.

Monzo’s coverage is narrower, focused on UK-based customers sending to select countries via Wise. It’s well suited for European transfers but doesn’t match Western Union’s global reach.

For worldwide remittance data, see:

https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues

Panda Remit supports over 40 currencies and multiple payment methods such as POLi, PayID, bank cards, and e-transfers, offering broad digital coverage.

Western Union vs Monzo: Which One is Better?

Choosing between Western Union vs Monzo depends on your needs:

-

Choose Western Union if you require cash pickups, serve recipients in rural or underbanked areas, or value its massive physical network.

-

Choose Monzo if you prefer transparent pricing, low fees, and a fully digital banking experience within supported regions.

For many users, Panda Remit (https://www.pandaremit.com) provides better overall value—with low fees, competitive exchange rates, and fast transfers.

Conclusion

In this Western Union vs Monzo comparison, both services have clear strengths. Western Union remains the global leader in reach and cash accessibility, while Monzo delivers a modern, low-cost digital experience for everyday users.

However, if your priority is low fees, high exchange rates, and fast, hassle-free online transfers, Panda Remit (https://www.pandaremit.com) is an excellent alternative:

-

High exchange rates & low fees

-

Flexible payment options (POLi, PayID, bank cards, e-transfer)

-

Support for 40+ currencies

-

Fast, fully online transfers

For additional insights, visit:

https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues

https://www.nerdwallet.com/best/international-money-transfer