Western Union vs Starling Bank: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 15:44:04.0 16

Introduction

In today’s global economy, sending money across borders has become a common need for businesses and individuals alike. High fees, slow transfers, hidden charges, and complicated user interfaces are common pain points for many users. This article compares Western Union vs Starling Bank, analyzing their fees, exchange rates, speed, security, and global coverage to help you choose the right service. For those seeking alternatives, PandaRemit offers fast, low-cost, and fully online transfers across 40+ currencies.

Reference for global money transfer insights: https://www.investopedia.com/articles/personal-finance/080815/best-ways-send-money-internationally.asp

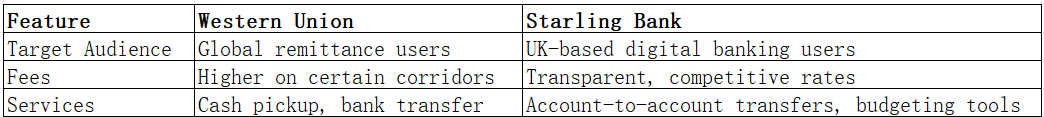

Western Union vs Starling Bank – Overview

Western Union (founded 1851) is a globally recognized money transfer service operating in over 200 countries. It supports cash pickup, bank transfers, and online payments, accessible through mobile and desktop apps.

Starling Bank (founded 2014) is a UK-based digital bank offering multi-currency accounts, domestic and international transfers, and debit card services. Its mobile-first interface targets tech-savvy users who prefer online banking.

Similarities:

-

Both support international money transfers and mobile apps

-

Debit card integration

-

Online and mobile access

Differences:

PandaRemit also competes in this market, providing low-cost, fully online transfers.

External reference: https://www.investopedia.com/articles/personal-finance/080815/best-ways-send-money-internationally.asp

Western Union vs Starling Bank: Fees and Costs

Western Union charges variable fees depending on destination, transfer method, and payout option. Cash pickups are generally more expensive than bank transfers.

Starling Bank offers transparent fees with few hidden charges, particularly for account-to-account international transfers.

Account Type Considerations:

-

Western Union: No subscription, pay-per-transfer

-

Starling Bank: Free multi-currency accounts; low or no fees for many international transfers

Reference: https://www.nerdwallet.com/best/banking/international-money-transfer

PandaRemit offers a low-cost alternative for frequent transfers, with reduced fees and favorable exchange rates.

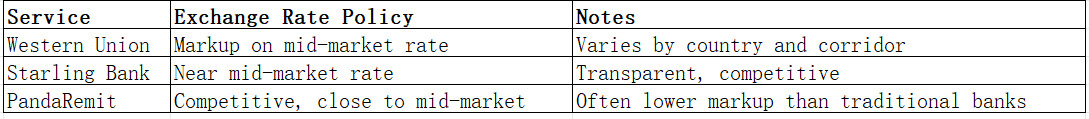

Western Union vs Starling Bank: Exchange Rates

Exchange rates can heavily affect how much the recipient receives.

PandaRemit is often preferred by users aiming for maximum transfer value due to its competitive rates.

Western Union vs Starling Bank: Speed and Convenience

Transfer Delivery Times:

-

Western Union: Instant to a few hours (cash pickup), 1–3 business days (bank transfer)

-

Starling Bank: 1–2 business days for most international transfers

App Usability & Integrations:

-

Western Union: User-friendly app, multiple payout options

-

Starling Bank: Mobile-first interface, direct account transfers, budgeting tools

Reference: https://www.worldremit.com/en/speed

PandaRemit provides fast, fully online transfers as a convenient alternative for users prioritizing speed.

Western Union vs Starling Bank: Safety and Security

Both brands maintain strong security measures:

-

Regulatory oversight: Western Union (licensed globally), Starling Bank (regulated by UK FCA)

-

Encryption and fraud protection

-

Buyer protection and dispute resolution

PandaRemit is also a licensed, secure service ensuring safe cross-border transactions.

Western Union vs Starling Bank: Global Coverage

-

Western Union: Operates in over 200 countries, supports multiple currencies, offers cash pickup and bank transfers

-

Starling Bank: UK-focused, supports selected international transfers with competitive rates

Reference: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues

Western Union vs Starling Bank: Which One is Better?

-

Western Union: Ideal for users needing global cash pickup options

-

Starling Bank: Best for UK users seeking low fees, transparent rates, and digital banking

For users prioritizing a balance of low fees, fast transfers, and broad currency support, PandaRemit can be a better choice.

Conclusion

When evaluating Western Union vs Starling Bank, both offer strong international money transfer services, but they differ in cost, speed, and user focus. Western Union excels in global reach and cash pickup, while Starling Bank is a transparent, tech-forward banking solution.

For those seeking fast, low-fee, multi-currency transfers, PandaRemit provides:

-

High exchange rates & low fees

-

Flexible payment options: POLi, PayID, bank card, e-transfer

-

Coverage for 40+ currencies

-

Fully online, fast transfers

In the Western Union vs Starling Bank comparison, the right choice depends on whether coverage or convenience is your priority. For cost-sensitive and speed-focused users, PandaRemit is a modern, efficient alternative.

Official PandaRemit Site: https://www.pandaremit.com

Investopedia Remittance Tips: https://www.investopedia.com/articles/personal-finance/080815/best-ways-send-money-internationally.asp