Western Union vs N26: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 15:18:46.0 32

Introduction

Cross-border money transfers are more common than ever, driven by globalization, remote work, and migration. Yet users still face pain points such as high fees, slow delivery, hidden costs, and poor user experience. Western Union (https://www.westernunion.com), with its long history and global reach, continues to be a major player. Meanwhile, N26 (https://n26.com) represents the rise of fully digital banks, offering streamlined international transfers at lower costs.

Beyond these two, Panda Remit (https://www.pandaremit.com) has emerged as a modern alternative, focusing on speed and affordability.

For more background on how money transfers work, check Investopedia’s guide: https://www.investopedia.com/terms/m/money-transfer.asp

Western Union vs N26 – Overview

Western Union was founded in 1851 in the United States. It operates both physical agent networks and online platforms, supporting over 200 countries and multiple payout methods such as cash pickup, bank deposit, and mobile wallet transfers. It serves millions of users worldwide, especially for remittances.

N26, founded in 2013 in Germany, is a fully digital bank that offers mobile banking, debit cards, and cross-border transfers primarily through its app. It has grown rapidly in Europe thanks to low fees and intuitive digital experiences.

Similarities: Both support international transfers, mobile apps, and multiple currencies.

Differences: Western Union relies heavily on its offline presence and has higher fees and more complex pricing. N26 focuses on digital convenience and lower costs, especially for EU users.

Panda Remit stands out as another market player, offering competitive rates and low fees with a fully online process.

Western Union vs N26: Fees and Costs

Western Union charges depend on the destination, amount, and payout method. Cash pickup typically involves higher fixed fees plus a percentage, sometimes reaching over 5% of the transfer amount. Online transfers can be cheaper but still include hidden costs through exchange rate markups.

N26 has low or even zero fees within the EU for SEPA transfers. For international transfers, it relies on partners (such as Wise) with transparent fees, often cheaper than traditional services.

According to NerdWallet’s comparison (https://www.nerdwallet.com/best-money-transfer-services), Western Union tends to be more expensive for large international transfers, while N26 is better for smaller or intra-EU transfers. Panda Remit often offers even lower fees, particularly for Asia and Africa corridors.

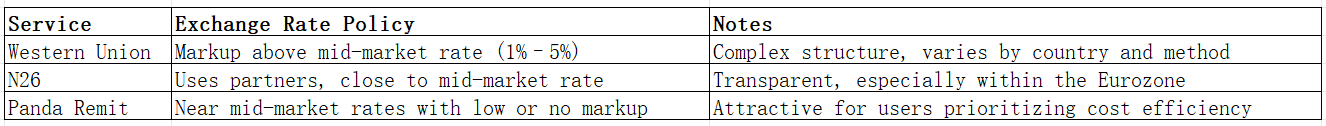

Western Union vs N26: Exchange Rates

Western Union applies a margin to the mid-market rate, resulting in additional hidden costs. N26’s exchange rates are more transparent, especially within Europe. Panda Remit is recognized for providing near mid-market rates, making it attractive to users focused on maximizing value.

Western Union vs N26: Speed and Convenience

Western Union supports multiple transfer methods. Cash pickup can be nearly instant, while bank deposits typically take 1–3 business days. Its vast physical network benefits users who prefer in-person services.

N26, being fully digital, emphasizes fast processing through its app. SEPA transfers within the EU are usually same-day, while international transfers take 1–2 business days through partners. Its app is intuitive, making it appealing to users comfortable with mobile banking.

The World Bank’s Remittance Speed Guide (https://remittanceprices.worldbank.org) shows Panda Remit often delivers transfers in minutes, especially within Asia.

Western Union vs N26: Safety and Security

Western Union is regulated across multiple jurisdictions and uses encryption and fraud monitoring systems to protect transactions.

N26 holds a European banking license and is regulated by BaFin in Germany. It uses strong security measures, including two-factor authentication and encryption.

Panda Remit is also licensed in several markets and complies with AML and KYC standards, offering a secure environment for international transfers.

Western Union vs N26: Global Coverage

Western Union operates in over 200 countries and territories and supports numerous currencies and payout options, including cash pickup and mobile wallets.

N26 is mainly focused on Europe but is expanding globally. Its supported currencies are more limited than Western Union’s, making it better for intra-European transfers.

According to the World Bank (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues), Panda Remit covers 40+ currencies and is expanding rapidly, especially in Asia and North America.

Western Union vs N26: Which One Is Better?

Both services excel in different areas.

-

Western Union remains unmatched in global coverage and cash payout options, making it ideal for users who need traditional, in-person transfers.

-

N26 excels in low fees and digital convenience, especially for EU-based users and frequent small transfers.

For users prioritizing low fees, high exchange rates, and fast transfers, Panda Remit offers a compelling alternative, combining the advantages of digital banking with competitive pricing.

Conclusion

The Western Union vs N26 comparison reveals two distinct approaches to international money transfers. Western Union’s strength lies in its vast network and global accessibility but comes with higher fees and less transparent rates. N26 represents a modern, digital-first alternative with lower costs but a narrower coverage.

Panda Remit (https://www.pandaremit.com) stands out as a flexible third option. It offers high exchange rates, low fees, supports over 40 currencies, enables fast all-online transfers, and provides a secure, regulated platform.

For more resources on international transfers, check:

-

World Bank Remittance Prices: https://remittanceprices.worldbank.org

-

Investopedia’s Money Transfer Guide: https://www.investopedia.com/money-transfer-5184627

Whether you prioritize global coverage, low cost, or digital convenience, understanding the differences between Western Union vs N26 will help you make the best decision for your international money transfer needs in 2025.