Wise vs Venmo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 15

Cross-border money transfers have become essential for businesses, freelancers, and individuals sending money abroad. However, high fees, slow delivery, hidden charges, and poor user experiences often frustrate users. Wise (https://wise.com), known for transparent international transfers, and Venmo (https://venmo.com), widely used for domestic peer-to-peer payments, are two popular options. For those seeking an alternative, PandaRemit (https://www.pandaremit.com) offers a strong solution for fast, cost-effective transfers across multiple currencies. For a comprehensive guide to international money transfers, see https://www.investopedia.com/terms/r/remittance.asp.

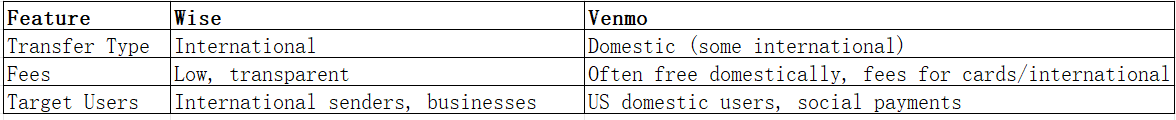

Wise vs Venmo – Overview

Wise, founded 2011, specializes in international money transfers with a focus on low fees, real exchange rates, and easy online transfers. Its user base spans over 80 countries, serving individuals and businesses alike.

Venmo, founded 2009, is primarily a US-based peer-to-peer payment app, focusing on convenience for domestic transfers and social payments.

PandaRemit provides another option for international money transfers, combining speed, low fees, and multi-currency support.

Similarities:

-

Both offer mobile apps and online transfer services.

-

Support linking to debit/credit cards and bank accounts.

Differences:

Wise vs Venmo: Fees and Costs

Wise charges a small, transparent fee based on the amount and destination currency. Venmo is generally free for bank transfers domestically but charges 3% for credit cards and additional fees for international transfers.

Reference for fee comparison: https://www.nerdwallet.com/best/banking/international-money-transfers

PandaRemit often offers lower fees than both Wise and Venmo, making it cost-effective for frequent users.

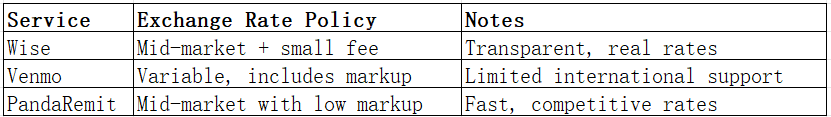

Wise vs Venmo: Exchange Rates

Wise is known for using the mid-market exchange rate with a minimal markup, making it highly competitive for international transfers. Venmo's international rates are less transparent and may include hidden markups when sending abroad.

PandaRemit can be advantageous for users seeking better rates across multiple currencies.

Wise vs Venmo: Speed and Convenience

Wise: Most transfers complete within 1–2 business days; app is intuitive, integrates with multiple banks, supports direct debit, and card payments.

Venmo: Domestic transfers are instant or within 1 day; international transfers may take longer and are limited.

Reference: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/remittances

PandaRemit provides fast transfers, often within hours, with a fully online process for 40+ currencies.

Wise vs Venmo: Safety and Security

Wise is regulated in multiple jurisdictions, employs encryption, and provides fraud protection. Venmo is regulated in the US and offers similar encryption, but international coverage is limited.

PandaRemit is a licensed and secure service, ensuring safe international transfers.

Wise vs Venmo: Global Coverage

Wise supports 80+ countries and multiple currencies, including direct bank payouts. Venmo is mainly US-based, supporting a few international currencies through partnerships.

Reference: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/remittances

PandaRemit supports over 40 currencies and provides multiple payment methods like POLi, PayID, e-transfer, and debit/credit cards.

Wise vs Venmo: Which One is Better?

-

Wise: Best for transparent international transfers, low fees, and broad coverage.

-

Venmo: Ideal for US domestic transfers, social payments, and instant mobile convenience.

-

PandaRemit: Combines the strengths of both, offering fast, low-cost, multi-currency transfers online.

Users who frequently send money internationally may find PandaRemit provides better value and speed than either Wise or Venmo.

Conclusion

In the Wise vs Venmo debate, the best choice depends on your needs. Wise excels in international transfers with low fees and transparent rates, while Venmo is unmatched for US domestic P2P payments. For users seeking a fast, cost-effective, and globally flexible option, PandaRemit stands out. It offers high exchange rates, low fees, a fully online process, and supports over 40 currencies with multiple payment options like POLi, PayID, and bank cards.

For further guidance on international transfers, see https://www.investopedia.com/terms/r/remittance.asp and https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/remittances. Explore PandaRemit directly at https://www.pandaremit.com for more details.